Simple. Good. Jobs. Join Team Schmid!

Your future at Gebäudetechnik Schmid. Are you looking not just for a job, but for a team you can rely on? Do you want to install technology that really inspires? Then you've come to the right place

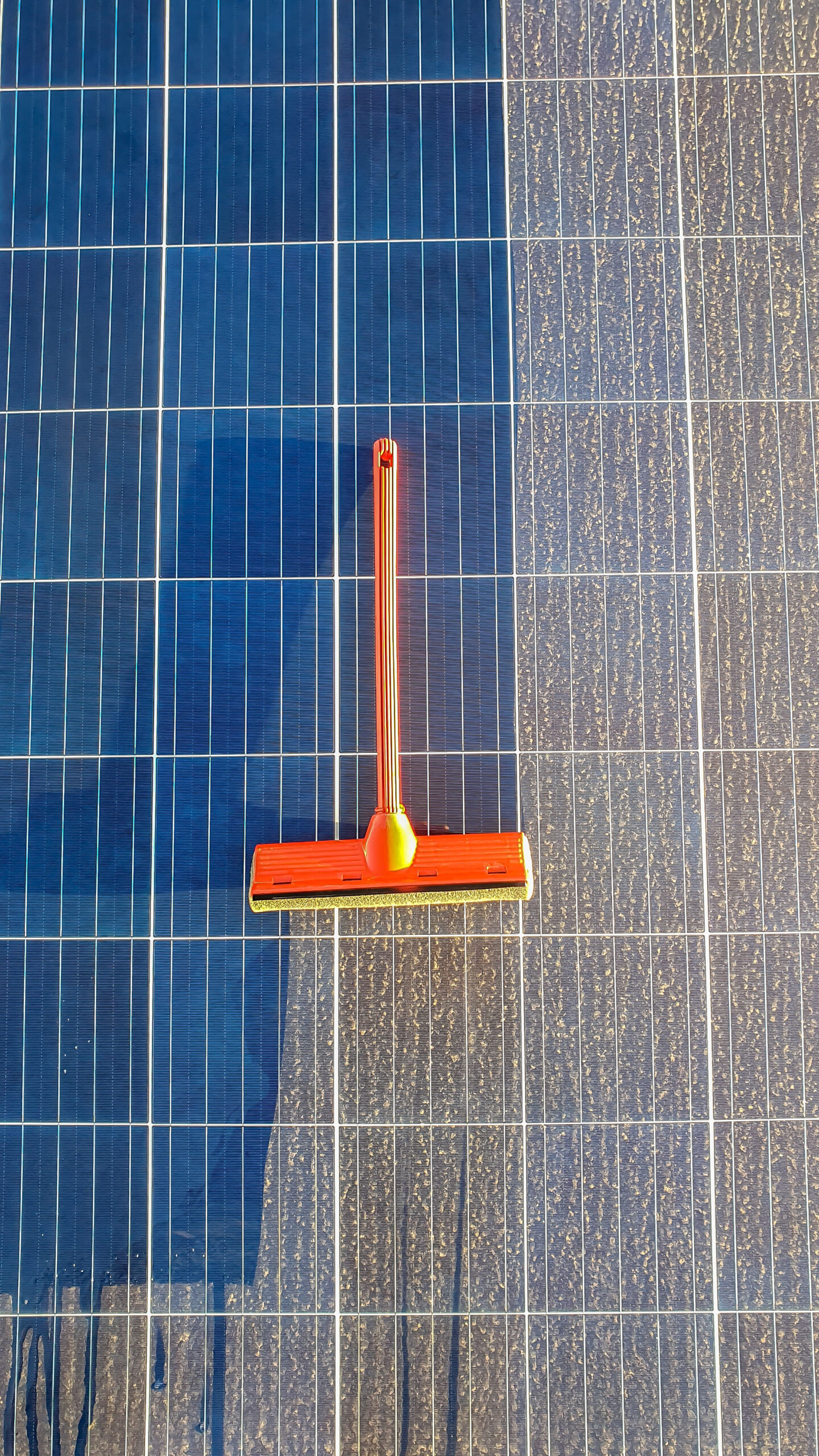

Cleaning solar power systems for your company

Whether new build, renovation or extension: Professional planning and advice is the cornerstone of a successful building technology project

Whether new build or renovation: The right building technology plays a key role in the energy efficiency, comfort and safety of your building

As an experienced specialist in ventilation and building technology, Schmid Gebäudetechnik offers a comprehensive range of maintenance and service work

Sustainably clean – permanently profitable

A clean plant is an efficient plant. In the world of renewable energies, every percentage point of efficiency counts. Our regular and professional maintenance not only ensures you receive the maximum feed-in tariff, but also allows you to make an active contribution to the energy transition. Only a fully functional, residue-free system can exploit the sun's potential to the full and justify your investment from day one.

Do the yield check

Every location is unique – a facility near a forest requires a different maintenance frequency than a facility on a farm or in an industrial area.

We would be happy to visit your facility and create a customised cleaning concept for you., that is precisely tailored to your specific site conditions and pollution levels. This means you only invest in measures that deliver measurable added value for your yield.

Why professional cleaning is essential:

The solar industry is changing – and so are the demands of system owners. While it was previously believed that photovoltaic systems were maintenance-free, long-term studies now paint a different picture: without maintenance, the system ages prematurely and delivers significantly less energy.

1. Economic advantages: securing returns

Increase in yield: Layers of dirt act like artificial shading. Professionally cleaned modules immediately achieve a performance increase of 10% to 25%.

Accelerate amortisation: A clean system produces more electricity. This means that the acquisition costs of your solar system pay for themselves much more quickly.

Tax deductibility: For private individuals, cleaning costs are often classified as household-related services, while commercial operators can deduct them in full as operating costs.

2. Technical necessity: avoiding damage

Avoiding hotspots: Localised contamination (such as sticky bird droppings) causes individual cells to overheat. These so-called "hotspots" can cause permanent damage to the module or, in the worst case, cause fires.

Protection against glass corrosion: Dust, soot and organic deposits can react chemically with moisture, damaging the anti-reflective coating on the glass.

Maintaining frame integrity: Moss and algae tend to accumulate on the edges of the frame. If this material freezes in winter, it can push the seals away and allow water to penetrate the module.

3. Ecological added value: genuine sustainability

Maximum CO2 savings: Only a plant operating at 100% capacity can replace the maximum amount of fossil fuels.

Chemical-free care: By using demineralised water (osmosis technology), we clean in an absolutely environmentally friendly way, without polluting the groundwater or adjacent green spaces.

Conclusion: Investment rather than cost factor

Professional cleaning is not a cost that reduces profits, but rather an investment that increases them. Investment in performance. It ensures that your system will still deliver the energy promised to you at the time of purchase, even after 10 or 20 years.

Professional cleaning & care

We offer you a comprehensive, worry-free package for your photovoltaic system. Our services are designed to maximise the efficiency of your system and maintain its value in the long term.

1. Analysis & Preparation

Free initial consultation: Individual assessment of the degree of contamination on site or via aerial photography.

Location analysis: Identification of specific sources of pollution (e.g. agriculture, industry, proximity to forests).

Creation of a cleaning concept: Determination of the optimal cleaning intervals and the required technology.

2. Professional deep cleaning

Ecological osmosis cleaning: Use of 100% demineralised water for streak-free drying without chemicals.

Gentle brushing technique: Use of special water-fed brushes (rotating or stationary) that are specifically certified for solar safety glass.

Frame & edge cleaning: Thorough removal of moss, lichen and dirt accumulations in the lower frame areas to prevent waterlogging.

Focus on "stubborn deposits": Professional removal of sticky pollen, bird droppings, soot particles and sticky resins.

3. Safety & Technology

Non-contact method: Use of telescopic poles and modern access systems (aerial platforms/ladders) to consistently avoid entering the modules.

Professional backup: Working in accordance with strict occupational health and safety regulations (UVV) to protect personnel and buildings.

4. Additional services & documentation (the added value check)

Visual inspection: During cleaning, we check for obvious defects such as broken glass, damaged cables, loose terminals or damage caused by martens.

Before and after documentation: Upon request, we can take photographs of the cleaned areas for your records.

Maintenance subscription: Automated cleaning cycles so you don't have to worry about a thing – for consistently optimal yields.

High-tech cleanliness: cleaning with nano effect

While conventional cleaning methods merely remove dirt, we go one crucial step further. Through the combined use of demineralised osmosis water and special Nano-particle process We refine the surface of your modules during the cleaning process.

How the principle of nano cleaning works

Imagine the glass surface of your solar modules under a microscope: even smooth glass is actually rough and full of microscopic "valleys". Dust, soot and pollen accumulate here.

Deep cleaning: The nanoparticles penetrate these tiny irregularities and dissolve even the most stubborn molecular compounds (e.g. fatty exhaust gases or sticky tree resins) that normal water would simply overlook.

Pore sealing: During cleaning, the nanoparticles fill in these microscopic irregularities. The glass is smoothed at the molecular level.

The lotus effect: An ultra-smooth protective layer is created. Water immediately rolls off (beading effect), simply carrying away any newly deposited dirt particles.

Your exclusive advantages of nano cleaning:

Longer cleanliness: Thanks to the smoothed surface, dirt particles can no longer adhere. The intervals between cleaning are significantly longer.

Non-stick guarantee: Bird droppings, moss and lichen can no longer 'bite' into the glass as firmly. This protects the sensitive anti-reflective coating on your modules.

Optimal light refraction: The nano-finish optimises light incidence when the sun is low in the sky (morning and evening hours), which further stabilises your yield.

Environmentally friendly: Despite its high-tech effect, the process remains biologically harmless and does not damage the seals or frames of your system.

Conclusion:

Standard cleaning: Removes surface dirt. The rough glass structure remains open to new deposits.

Nano-particle cleaning: Cleans deeply and seals the surface. Dirt will simply slide off in future. That's the "new car effect" for your roof!

In the current market environment (as of 2026), having their own solar power system is one of the most effective measures companies can take to reduce costs and minimise risk. The advantages can be divided into three key areas:

Economic efficiency: Self-generated solar power will cost you approximately the following over the lifetime of the system 7 to 10 pence per kWh. Compared to purchasing grid electricity (which often costs 25 pence or more), you save money with every kilowatt hour you consume yourself. This leads to a sustainable reduction in your operating costs and an attractive return on invested capital.

Planning reliability & independence: With a photovoltaic system, you can secure your energy costs for the next 25 to 30 years You become independent of unpredictable price fluctuations on the electricity market and can calculate stable energy costs in the long term – a decisive competitive advantage.

ESG compliance and image: Sustainability is a tough economic criterion these days. By producing clean electricity, you can measurably improve your carbon footprint. This not only helps you meet legal reporting requirements (ESG), but also strengthens your position with customers, investors and as an attractive employer.

Added value through innovation: Modern systems enable you to power your electric fleet cost-effectively and – thanks to new legislation coming into force in 2026 – participate in Lokalen Elektrizitätsgemeinschaften (LEG), um überschüssigen Strom profitabel an Nachbarn zu verkaufe

The optimal investment depends on your Load profile and your aiming:

For maximum savings: A system that is precisely tailored to your own consumption during operating hours (during the day). This guarantees the fastest return on investment.

Für maximale Rendite: Eine Vollbelegung der Dachflächen. Seit dem neuen Stromgesetz 2026 lohnt sich der Verkauf von Überschussstrom an Nachbarn (LEG) oder ins Netz dank garantierter Mindestvergütungen besonders.

For cost certainty: A combination with battery storage, to break expensive peak loads (peak shaving) and reduce grid costs.

Conclusion: The "right" system makes the best possible use of your roof to replace expensive grid electricity (approx. 30 Rp./kWh) with cheap self-generated electricity (approx. 8–12 Rp./kWh).

.

The investment costs depend primarily on the size of the system. Since fixed costs (such as scaffolding and planning) are less significant for large commercial roofs, the price per kilowatt peak (kWp) decreases as the area increases.

Guidelines for 2026 (gross investment before deductions):

Small businesses (approx. 10–30 kWp): CHF 1,800 to 2,400 per kWp.

Medium-sized businesses (approx. 30–100 kWp): CHF 1,400 to 1,800 per kWp.

Industry (from 100 kWp): CHF 1’100.– bis 1’400.– pro kWp.

Which subsidies and deductions reduce the price?

In Switzerland, you can significantly reduce the actual costs by three factors (often by 30% to 45%):

One-off payment (Pronovo): The federal government will pay you a one-off investment contribution. For commercial installations (GREIV), this often covers up to 30% of the investment costs..

Tax deduction: Investments in solar systems can be deducted from taxable income as property maintenance in almost all cantons.

Cantonal subsidies: Some cantons or municipalities offer additional subsidy programmes or bonuses (e.g. for facade installations).

What running costs should I expect?

Solar systems require very little maintenance. Calculate approximately 1% of the investment amount for:

Maintenance and technical inspections.

Insurance premiums (liability/property insurance).

Occasional cleaning (depending on location and roof pitch).

When will the system pay for itself?

Thanks to the minimum remuneration Thanks to feed-in tariffs and high electricity prices for grid purchases, commercial installations in Switzerland currently pay for themselves after 7 to 11 years old. With a service life of over 25 years, the system will then produce virtually free electricity for your business for at least 15 years.

Yes, absolutely. In Switzerland, the construction of photovoltaic systems is heavily subsidised by the federal government and often additionally by cantons or municipalities. The subsidy consists of three main pillars:

One-off payment (EIV): This is the most important subsidy provided by the federal government. You will receive a one-time investment grant, which is usually up to 30% of the investment costs covers.

For systems up to 100 kWp (KLEIV), you will receive fixed performance contributions (e.g. approx. 360 CHF per kWp for standard systems).

For large-scale installations above 100 kWp (GREIV), specific rates apply that significantly lower your investment hurdle.

Additional bonuses (new & increased in 2026): Special installations will be rewarded separately.

Angle of inclination bonus: Systems installed on façades or pitched roofs (over 75°) that generate a lot of electricity, especially in winter, receive a bonus of up to 400 CHF per kWp.

Parking bonus: If you install photovoltaic systems above your company car parks, additional subsidies have recently become available.

Tax benefits: For companies, the investment costs are considered a business-related expense in most cantons. fully deductible. This reduces your taxable profit and indirectly shortens the amortisation period by several years.

Important for planning for 2026: Since 1 January 2026, you have also benefited from a legally guaranteed minimum remuneration for the electricity you feed into the grid (at least 6 Rp./kWh for small systems).

Applications for federal funding are submitted centrally via the cantonal enforcement agency. Pronovo. We recommend submitting your application as early as possible in order to benefit from the current quotas.

We offer various maintenance contracts to ensure the functionality and longevity of your system. Our trained specialists will reliably take care of the maintenance of your solar power system.

In the event of a malfunction, our 24/7 emergency service is at your disposal. We will rectify the fault quickly and competently so that your system works smoothly again.

Solar power systems are extremely reliable due to the absence of moving parts low maintenance, but not completely maintenance-free. For optimal yield over 25+ years, we recommend:

Regular monitoring: We (or you) monitor the yields digitally via an app or dashboard. This means that any irregularities are noticed immediately, without anyone having to be on site.

Technical check (every 2–4 years): A specialist checks the inverters, cabling and protective devices to ensure operational safety and fire protection requirements are met at all times.

Professional cleaning: Depending on the location and roof pitch, dust, pollen or leaves may accumulate. Cleaning every few years ensures you up to 5–10% higher yield.

Safety certificate (SiNa): In Switzerland, it is a legal requirement to have the electrical system checked after major modifications or at regular intervals.

Conclusion: Maintenance costs are minimal. The costs for this are usually less than 1% of annual income – an investment that pays for itself many times over thanks to the long service life of the system.

Simply explained: There isn't one. In technical language, the terms are often used synonymously.

Photovoltaics (PV): This term describes the physical technology – i.e. the direct conversion of sunlight into electrical energy using solar cells.

Solar power system: This is the colloquial and functional name for the entire system that uses this technology to supply your business with electricity.

Important distinction: The only distinction to be made is between solar power (photovoltaics) and solar heat (solar thermal energy). While a photovoltaic system supplies electricity for your machines, computers and electric cars, a solar thermal system only generates hot water. Due to its high cost-effectiveness, photovoltaic systems are almost always the first choice for businesses today.

The legal framework for photovoltaics in Switzerland was established by the new Electricity Act (effective from 1 January 2026) and the revision of the Spatial Planning Act have been significantly simplified, but they also entail new technical obligations:

Notification procedure instead of authorisation procedure: In most cases (on flat or pitched roofs in construction, industrial and commercial zones), you will need no building permit. A simple notification to the local authority 30 days before construction begins is sufficient, provided that the system is considered "sufficiently adapted". Since 2026, this simplified procedure has often also applied to façade systems.

The new 70% feed-in regulation: Since 1 January 2026, new installations must be designed so that a maximum of 70% of the installed module capacity fed into the public grid. This serves to maintain grid stability. Your own consumption is not affected by this – you can use 100% of the energy internally. An intelligent energy management system (EMS) helps you to comply with this requirement without significant losses.

Connection & acceptance: Each system must be registered with the local distribution network operator (DNO). After installation, an official Safety certificate (SiNa): by an independent inspection body is mandatory in order to confirm safe operation in accordance with the Low Voltage Installation Regulation (LVIR).

Solar obligation for new buildings: Please note that in many cantons (e.g. Aargau, Zurich) a solar obligation For new buildings or large roof renovations above a certain area (approx. 300 m²).2exists.

Fire safety & occupational safety: The installation must comply with the guidelines of the Association of Cantonal Fire Insurers (VKF). In addition, strict safety precautions (e.g. fall protection in accordance with Suva) are required by law during installation.

We are happy to advise you and support you in complying with all relevant standards and regulations.

You can contact us in various ways:

We look forward to your enquiry!

On our website, you will find a wealth of information about solar power systems, e.g.:

We will also be happy to send you free information material.

We offer you numerous advantages, e.g:

Schmid Gebäudetechnik – Ihr kompetenter Partner für Lüftungsanlagen, Solarstromanlagen und Gebäudetechnik!

We would be happy to advise you personally and without obligation on our range of services. Give us a call or send us an e-mail

Monday 08:00 - 17.00

Tuesday 08:00 - 17.00

Wednesday 08:00 - 17.00

Thursday 08:00 - 17.00

Friday 08:00 - 17.00

Schmid Gebäudetechnik - Your partner for ventilation and building technology!

Our trained employees ensure the smooth operation of your systems

Your future at Gebäudetechnik Schmid. Are you looking not just for a job, but for a team you can rely on? Do you want to install technology that really inspires? Then you've come to the right place

AXPO and Schmid Gebäudetechnik: together for the future! We are pleased to present our latest joint project, in which the experience of AXPO and the innovative strength of Schmid Gebäudetechnik work hand in hand.

Gesundes Raumklima und effiziente Energienutzung Eine Lüftungsanlage sorgt für ein angenehmes und gesundes Raumklima in Ihrem Zuhause oder Büro. Sie filtert die Luft, entfernt Schadstoffe und Feuchtigkeit und sorgt für

WhatsApp Kontakt